Advertisement

-

Published Date

June 22, 2018This ad was originally published on this date and may contain an offer that is no longer valid. To learn more about this business and its most recent offers, click here.

Ad Text

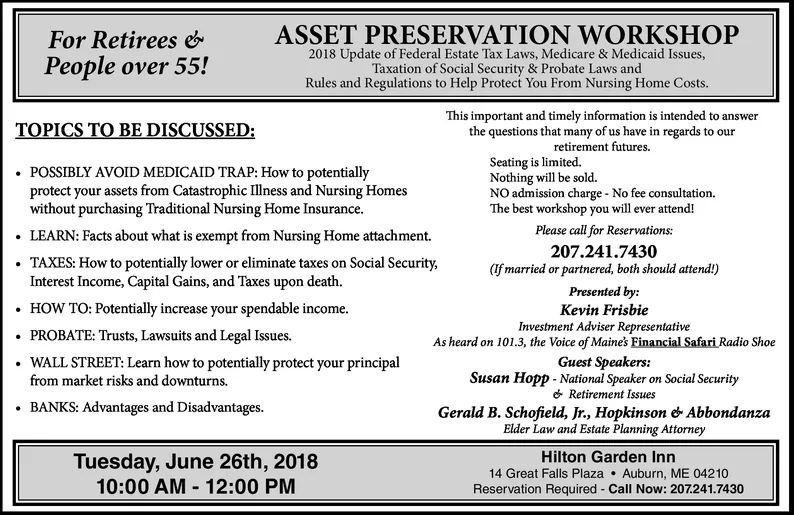

For Retirees &ASSET PRESERVATION WORKSHOP People over 55! 2018 Update of Federal Estate Tax Laws, Medicare & Medicaid Issues Taxation of Social Security & Probate Laws and Rules and Regulations to Help Protect You From Nursing Home Costs. This important and timely information is intended to answer the questions that many of us have in regards to our retirement futures. TOPICS TO BE DISCUSSED: Seating is limited. Nothing will be sold. POSSIBLY AVOID MEDICAID TRAP: How to potentially protect your assets from Catastrophic Illness and Nursing Homes without purchasing Traditional Nursing Home Insurance. . NO admission charge - No fee consultation. The best workshop you will ever attend! Please call for Reservations: 207.241.7430 (If married or partnered, both should attend) Presented by: Kevin Frisbie Investment Adviser Representative As heard on 101.3, the Voice of Maines Financial Safari Radio Shoe Guest Speakers: Susan Hopp National Speaker on Social Security Retirement Issues Gerald B. Schofield, Jr., Hopkinson & Abbondanza Elder Law and Estate Planning Attorney LEARN: Facts about what is exempt from Nursing Home attachment. . TAXES: How to potentially lower or eliminate taxes on Social Security Interest Income, Capital Gains, and Taxes upon death. HOW TO: Potentially increase your spendable income. PROBATE: Trusts, Lawsuits and Legal Issues. . WALL STREET: Learn how to potentially protect your principal from market risks and downturns. BANKS: Advantages and Disadvantages. Tuesday, June 26th, 2018 10:00 AM 12:00 PM Hilton Garden Inn 14 Great Falls Plaza Auburn, ME 04210 Reservation Required Call Now: 207.241.7430