Advertisement

-

Published Date

March 15, 2019This ad was originally published on this date and may contain an offer that is no longer valid. To learn more about this business and its most recent offers, click here.

Ad Text

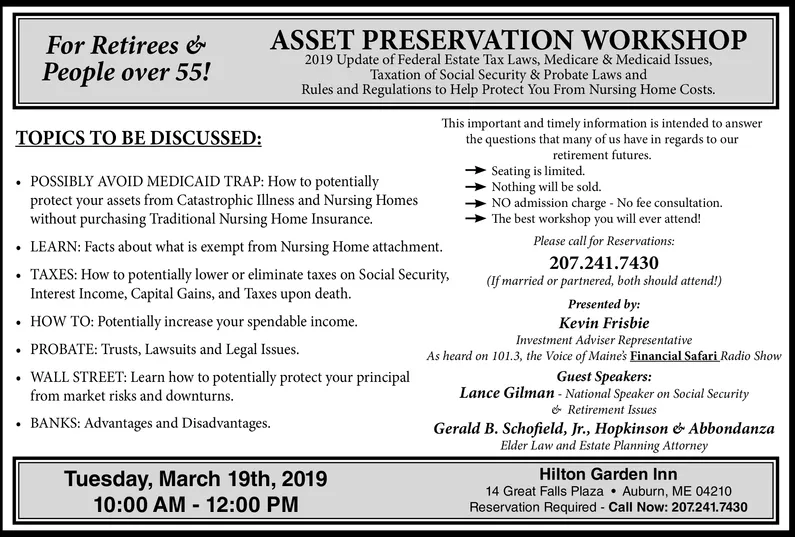

For Retirees People over 55! ASSET PRESERVATION WORKSHOP 2019 Update of Federal Estate Tax Laws, Medicare & Medicaid Issues Taxation of Social Security & Probate Laws and Rules and Regulations to Help Protect You From Nursing Home Costs This important and timely information is intended to answer the questions that many of us have in regards to our retirement futures. TOPICS TO BE DISCUSSED: Seating is limited. Nothing will be sold. POSSIBLY AVOID MEDICAID TRAP: How to potentially protect your assets fr Catastrophic Illness and Nursing Homes without purchasing Traditional Nursing Home Insurance NO admission charge . No fee consultation. The best workshop you will ever attend! LEARN: Facts about what is exempt from Nursing Home attachment. Please call for Reservations 207.241.7430 TAXES: How to potentially lower or eliminate taxes on Social Security,if married or partnered, both should attend) Interest Income, Capital Gains, and Taxes upon death. Presented by: Kevin Frisbie Investment Adviser Representative As heard on 101.3, the Voice of Maines Einancial Safari Radio Show Guest Speakers: Lance Gilman National Speaker on Social Security & Retirement Issues . HOW TO: Potentially increase your spendable income . PROBATE: Trusts, Lawsuits and Legal Issues. WALL STREET: Learn how to potentially protect your principal from market risks and downturns BANKS: Advantages and Disadvantages. . Gerald B. Schofield, Jr., Hopkinson & Abbondanza Elder Law and Estate Planning Attorney Tuesday, March 19th, 2019 10:00 AM 12:00 PM Hilton Garden Inn 14 Great Falls Plaza Auburn, ME 04210 Reservation Required Call Now: 207.241.7430