Advertisement

-

Published Date

February 8, 2020This ad was originally published on this date and may contain an offer that is no longer valid. To learn more about this business and its most recent offers, click here.

Ad Text

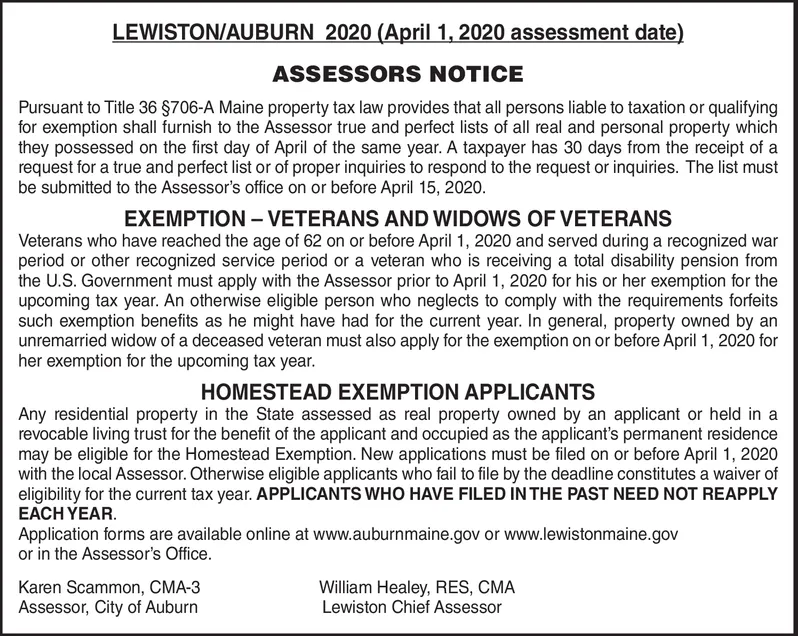

LEWISTON/AUBURN 2020 (April 1, 2020 assessment date) ASSESSORS NOTICE Pursuant to Title 36 §706-A Maine property tax law provides that all persons liable to taxation or qualifying for exemption shall furnish to the Assessor true and perfect lists of all real and personal property which they possessed on the first day of April of the same year. A taxpayer has 30 days from the receipt of a request for a true and perfect list or of proper inquiries to respond to the request or inquiries. The list must be submitted to the Assessor's office on or before April 15, 2020. EXEMPTION VETERANS AND WIDOWS OF VETERANS Veterans who have reached the age of 62 on or before April 1, 2020 and served during a recognized war period or other recognized service period or a veteran who is receiving a total disability pension from the U.S. Government must apply with the Assessor prior to April 1, 2020 for his or her exemption for the upcoming tax year. An otherwise eligible person who neglects to comply with the requirements forfeits such exemption benefits as he might have had for the current year. In general, property owned by an unremarried widow of a deceased veteran must also apply for the exemption on or before April 1, 2020 for her exemption for the upcoming tax year. HOMESTEAD EXEMPTION APPLICANTS Any residential property in the State assessed as real property owned by an applicant or held in a revocable living trust for the benefit of the applicant and occupied as the applicant's permanent residence may be eligible for the Homestead Exemption. New applications must be filed on or before April 1, 2020 with the local Assessor. Otherwise eligible applicants who fail to file by the deadline constitutes a waiver of eligibility for the current tax year. APPLICANTS WHO HAVE FILED IN THE PAST NEED NOT REAPPLY EACH YEAR. Application forms are available online at www.auburnmaine.gov or www.lewistonmaine.gov or in the Assessor's Office. Karen Scammon, CMA-3 Assessor, City of Auburn William Healey, RES, CMA Lewiston Chief Assessor LEWISTON/AUBURN 2020 (April 1, 2020 assessment date) ASSESSORS NOTICE Pursuant to Title 36 §706-A Maine property tax law provides that all persons liable to taxation or qualifying for exemption shall furnish to the Assessor true and perfect lists of all real and personal property which they possessed on the first day of April of the same year. A taxpayer has 30 days from the receipt of a request for a true and perfect list or of proper inquiries to respond to the request or inquiries. The list must be submitted to the Assessor's office on or before April 15, 2020. EXEMPTION VETERANS AND WIDOWS OF VETERANS Veterans who have reached the age of 62 on or before April 1, 2020 and served during a recognized war period or other recognized service period or a veteran who is receiving a total disability pension from the U.S. Government must apply with the Assessor prior to April 1, 2020 for his or her exemption for the upcoming tax year. An otherwise eligible person who neglects to comply with the requirements forfeits such exemption benefits as he might have had for the current year. In general, property owned by an unremarried widow of a deceased veteran must also apply for the exemption on or before April 1, 2020 for her exemption for the upcoming tax year. HOMESTEAD EXEMPTION APPLICANTS Any residential property in the State assessed as real property owned by an applicant or held in a revocable living trust for the benefit of the applicant and occupied as the applicant's permanent residence may be eligible for the Homestead Exemption. New applications must be filed on or before April 1, 2020 with the local Assessor. Otherwise eligible applicants who fail to file by the deadline constitutes a waiver of eligibility for the current tax year. APPLICANTS WHO HAVE FILED IN THE PAST NEED NOT REAPPLY EACH YEAR. Application forms are available online at www.auburnmaine.gov or www.lewistonmaine.gov or in the Assessor's Office. Karen Scammon, CMA-3 Assessor, City of Auburn William Healey, RES, CMA Lewiston Chief Assessor